Going Digital is the buzzword – conventional businesses are getting transformed, thanks to digital bandwagon! Each day, it’s developing some new ways to engage clients, associate with partners and strike better operational efficiencies. Today’s business houses are using digital power to enhance revenue and reduce cost, and we can’t agree more.

Digital business is generally the implementation of digital technologies to support business models through user behavior evolution and considerable regulation support. For an instance, let’s look at Uber:

- New Technology – Transportation technology platform

- Business Model – Driver-partners and riders model

- User Behavior Norm – Acceptance of non-traditional transportation method

- Regulation Support – Cities and countries modify regulation to strengthen models

Today, cyber security and technology risk-management are treasure keys to future business growth and prosperity – security industry has evolved a lot over the years in terms of risk mitigation measures. Digital transformation has made way for security transformation, and in this regard, below we’ve whittled down the elements used for security transformation:

Digital Technologies – Smart watches, smart cars, health bands, voice assistants and smart home devices are some of the latest digital technologies clogging the present industry. These devices are to be supported by robust application platforms using AI, Machine Learning and Big Data.

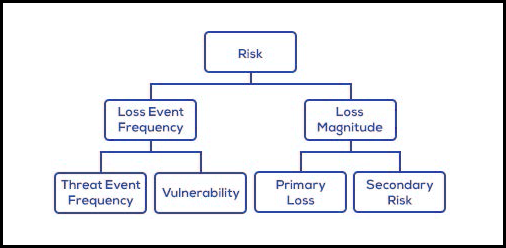

Business Models – Risk management techniques are perfect for determining information risks emanating from business processes. In digital businesses, dynamic processes are common and evolving. Traditional risk models can’t handle them.

Evolving User Behaviors – Consumers are king in the digital world. The users are empowered with tools to make their own choices. On the contrary, traditional security processes used to treat users as weak links.

Regulation Support – To manage risk, security and privacy, regulations around the globe are changing and control standards are being updated or modified. For effective adaptability with the relevant changes, compliance assurance and sustenance need to be modified.

A Few Fundamental Design Principles for Control Framework for Security Transformation

Business Accelerator – Only security is not just good enough for smooth digital transformation. Security has to take the role of an accelerator since the fundamental premise of going digital is to be fast in the market and enhance customer satisfaction.

Example – Biometric Authentic – it improves user speed and experience.

Technology Changes and Agile Design – The stream of technology is evolving – AI, ML, Blockchain, Virtual Reality, Internet of Things, etc. – every domain of technology is undergoing a robust transformation. Therefore, security controls have to be adaptable and agile in design.

Customer-oriented – Known to all, customers are the most important element in digital business. In the new digitized world, users are the ones who decide. Two-decade ago rule, ‘deny all, permit some’ is now changed into ‘permit all, deny some’ rule – and we are truly excited!

Automate and Digitize – It’s time security goes digital – automation is the key.

In the near future, risk management through security transformation is going to be the utmost priority for all risk managers –if you are interested in Market Risk Analytics, drop by DexLab Analytics. They are the best in town for recognized and reputable Value at Risk Model online training. For more, check out their official website.

The blog has been sourced from ― www.forbes.com/sites/forbestechcouncil/2018/09/27/the-digital-transformation-demands-large-scale-security-transformation/#64df7fc41892

Interested in a career in Data Analyst?

To learn more about Data Analyst with Advanced excel course – Enrol Now.

To learn more about Data Analyst with R Course – Enrol Now.

To learn more about Big Data Course – Enrol Now.To learn more about Machine Learning Using Python and Spark – Enrol Now.

To learn more about Data Analyst with SAS Course – Enrol Now.

To learn more about Data Analyst with Apache Spark Course – Enrol Now.

To learn more about Data Analyst with Market Risk Analytics and Modelling Course – Enrol Now.