Technology is critical. To improve efficiency, reduce costs, stay on the cutting edge over tailing rivals, fulfill customer requirements and initiate a proper risk management process, technology is an incredible tool to possess.

The abovementioned facts received momentum at the SAS Risk & Finance Analytics Roadshow in Lagos, during which it was inferred that the banks nowadays are adapting themselves to regulatory changes, thus reducing costs in no time.

In this context, Charles Nyamuzinga, Senior Business Solutions Manager, Pre-Sales Risk Practice, stated that banks in Africa need to confront with additional challenges, including risk analytics skills gaps, challenges associated with data management and integrating finance and risk management nuances across an organization.

“But, on the positive side, they have started considering technology as a way of eliminating these challenges, and have access to new streams of data that are also helping to advance the financial inclusion mandate,” he noted.

In compliance with global financial norms, African banks should by now be compliant with the new IFRS9 Accounting Standard, which comes with some changes in the way expected credit losses used to be calculated.

“There is also need to start thinking about the new ‘Basel IV’ framework, which impacts on how banks calculate their risk weighted assets, and the amount of capital they need to offset those risks,” he added.

According to Charles, banks are feeling intense regulatory pressure nowadays, while tussling with daily requirements, challenges and questions associated with taking stress tests. The regulators have become severe on stress testing processes, and that may be for good! Besides, banks need to worry about the effect on reputation, capital shortfalls and negative influence on earnings, along with non-compliance penalties.

His concern was thoroughly evident in these statements, “There’s a good chance that banks in Africa could get this wrong if they use disparate and fragmented systems for data management, model building and implementation and reporting – which is often the case – or if they try to do the computations manually.

“The biggest causes of incorrect modeling are data management and quality issues and skills shortages. Banks have to obtain and analyze enormous amounts of detailed data, for example. And, to comply with IFRS 9, banks must look at millions of customers with hundreds of data points.”

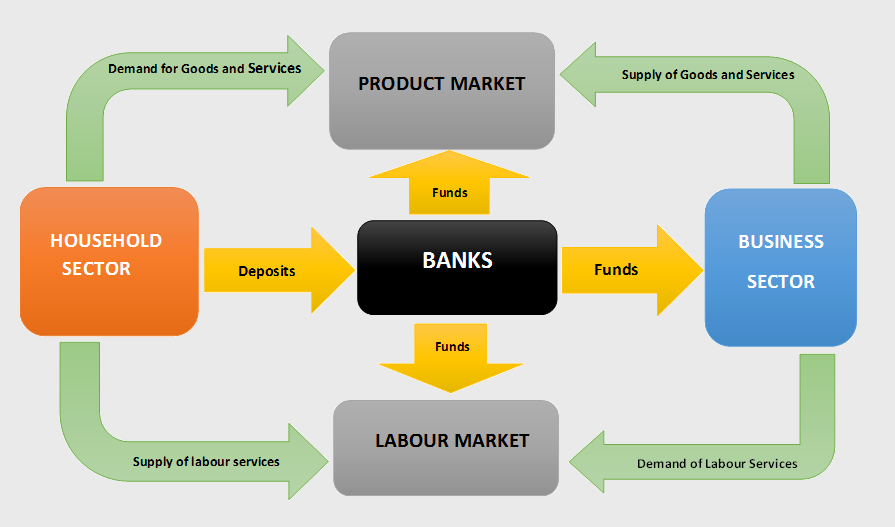

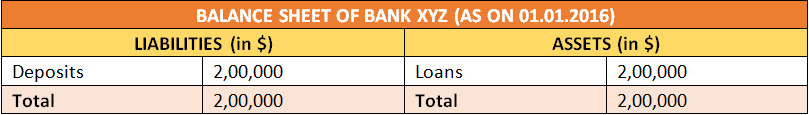

In support of the above observations, SAS Sales Manager, West Africa, Babalola Oladokun raised concerns if a bank ends up miscalculating a customer’s credit score, it would result in giving a loan to someone, who for sure won’t be able to repay it. This can have serious implications for IFRS 9expected credit loss calculations. Furthermore, if a bank lacks in capital on hand to offset the loan deficiency, the case will go straightaway to Basel Capital requirements compliance issues.

“Data gathering and manipulation from disparate data sources wastes time and resources that banks could have used to develop new products and find more convenient ways to serve their customers – something their competitors in the FinTech space are very good at,” he noted.

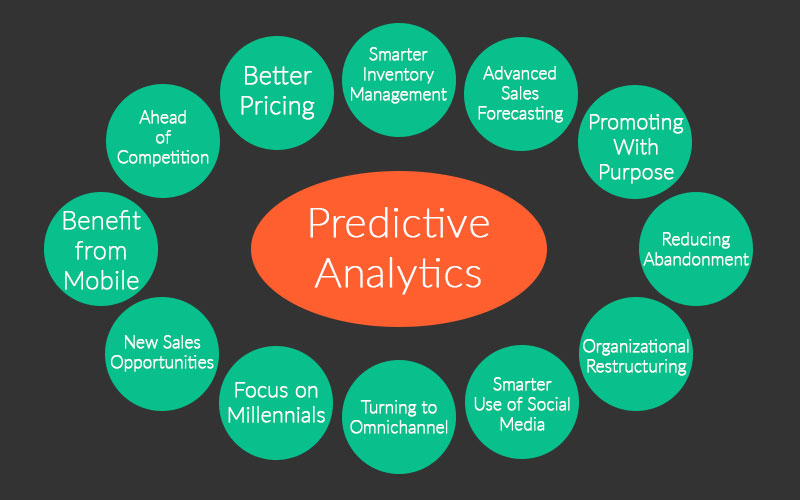

As last thoughts, FinTechs use virgin data streams to draw instant conclusions and fuel decision-making processes for customers. For an example, they base their inferences about granting a loan to someone who doesn’t even have a bank account – surely, this is an innovative way to give non-banking population access into the world of finance.

If finance and big data interests you, we suggest you go through our credit risk management courses in Delhi. DexLab Analytics is not only a trailblazer in credit risk modelling courses, but also a robust platform for training young minds.

This article first appeared in – https://guardian.ng/business-services/technology-crucial-to-tackling-risks-skill-gaps-in-banks

Interested in a career in Data Analyst?

To learn more about Data Analyst with Advanced excel course – Enrol Now.

To learn more about Data Analyst with R Course – Enrol Now.

To learn more about Big Data Course – Enrol Now.To learn more about Machine Learning Using Python and Spark – Enrol Now.

To learn more about Data Analyst with SAS Course – Enrol Now.

To learn more about Data Analyst with Apache Spark Course – Enrol Now.

To learn more about Data Analyst with Market Risk Analytics and Modelling Course – Enrol Now.