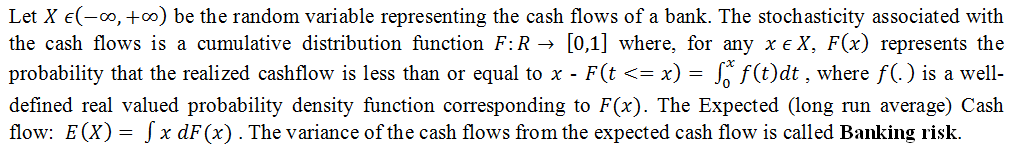

Banking risk refers to the future uncertainty which creates stochasticity in the cash flow from receivables of outstanding balances. Banking Risks can be described in the Vonn-Neumann-Morgenstern (VNM) framework of Money lotteries. In this framework, the set of outcomes are assumed to be continuous and monetary in nature, and the lottery is a list of probabilities associated with the continuous outcomes. When applied to the banking framework, the cash flows (the set of outcomes) are assumed to be continuous and stochastic in nature. A theoretical model for the risk is represented in the framework below:

There are three broad sources from which banking risks originate: 1. Credit Risk 2. Market Risk 3. Operational Risk.

CREDIT RISK:

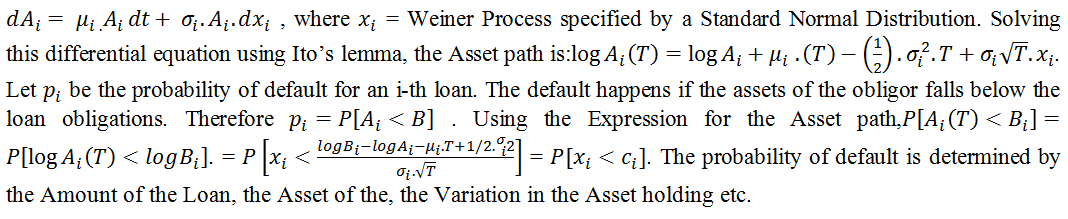

Credit Risk arises when the borrower defaults to honour the repayment commitments on their debts. Such a risk arises as a result of adverse selection (screening) of applicants at the stage of acquisitions or due to a change in the financial capabilities of the borrower over the process of repayment. A loan will default if the borrower’s assets (A) at maturity (T) falls below the contractual value of the obligations payable (B) (Vasicek,1991). Let A_i be the asset of the i-th borrower, which is described by the process:

MARKET RISK:

Market Risk includes the risk that arises for banks from fluctuation of the market variables like: Asset Prices, Price levels, Unemployment rate etc. This risk arises from both on-balance sheet as well as off-balance sheet items. This risk includes risk arising from macroeconomic factors such as sharp decline in asset prices and adverse stock market movements. Recessions and sudden adverse demand and supply shock also affect the delinquency rates of the borrowers. Market Risk includes a whole family of risk which includes: stock market risks, counterparty default risk, interest rate risk, liquidity risk, price level movements etc.

OPERATIONAL RISK:

Operational Risk arises from the operational inefficiencies of the human resources and business processes of an organisation. Operational risk includes Fraud risks, bankruptcy risks, risks arising from cyber hacks etc. These risks are uncorrelated across the industries and is very organisation specific. However, Operational risk excludes strategy risk and reputation risk.

This blog is the continuation of the first blog, which was on the topic – The Basics of the Banking Business and Lending Risks. To read the blog, click here ― www.dexlabanalytics.com/blog/the-basics-of-the-banking-business-and-lending-risks

Stay glued to our site for further details about banking structure and risk modelling. DexLab Analytics offers a unique module on credit risk analysis training in Bangalore.

Interested in a career in Data Analyst?

To learn more about Data Analyst with Advanced excel course – Enrol Now.

To learn more about Data Analyst with R Course – Enrol Now.

To learn more about Big Data Course – Enrol Now.To learn more about Machine Learning Using Python and Spark – Enrol Now.

To learn more about Data Analyst with SAS Course – Enrol Now.

To learn more about Data Analyst with Apache Spark Course – Enrol Now.

To learn more about Data Analyst with Market Risk Analytics and Modelling Course – Enrol Now.