It is important for banks to be customer centric because a customer who is better engaged is easier to retain and do business with. In order to provide services that are valued by customers, banks need to exploit big data. When big data is combined with analytics it can result in big opportunities for banks. The volume of banking customers is on the rise, and so is their data. It is time for the banking sector to look beyond traditional approaches and adopt new technologies powered by big data, like natural language processing and text mining, which help convert large amount of unstructured information into meaningful data that can lead to valuable insights.

Switching to big data enable banks to get a 360-degree view of their customers and keep providing excellent services. Many banks, like the Bank of America and U.S. Bank, have implemented big data analytics and are reaping its benefits. Rabobank, which has adopted big data analytics to detect criminal activity in ATMs, is ranked among the top 10 safest banks in the world.

Big Data’s Advantages for the Banking Industry:

- Streamline Work Process and Service Delivery:

Banks need to filter through gazillions of data sets in order to provide relevant information to a customer, when he/she enters account details into the system. Big data can speed up this process. It enables financial institutes of spot and correct problems, before they affect clients. Big data also helps in cost-cuttings, which in turn lead to higher revenues for banks.

In case of erroneous clients, who tend to go back on their decisions, big data can help alter the process of service delivery in such a manner that these clients are bound to stick to their commitments. It allows banks to track credit and loan limits, so that customers don’t exceed them.

Cloud based analytics packages sync in with big data systems to provide real-time evaluation. Banks can sift through tons of client information to track transactional behaviors in real time and provide relevant resources to clients. Real-time client contact is very useful in verifying suspicious transactions.

- Customer Segmentation:

Big data help banks understand customer spending habits and determine their needs. For example, when we use our credit cards to purchase something, banks acquire information about what we purchase, how much we spend and use these information to provide relevant offers to us. Through big data, banks are able to trace all customer transactions and answer questions about a customer, like which services are commonly accessed, what are the preferred credit card expenditures and what his/her net worth is. The advantage of customer segmentation is that it enables banks to design marketing campaigns that cater to specific needs of a customer. It can be used to deliver personalized schemes and plans. Analyzing the past and present expenses of a client helps bank create meaningful client relationships and improve response rates.

- Fraud detection:

According to Avivah Litan, a financial fraud expert at Gartner, big data supports behavioral authentication, which can help prevent fraud. Litan says, ‘’using big data to track such factors as how often a user typically accesses an account from a mobile device or PC, how quickly the user types in a username and password, and the geographic location from which the user most often accesses an account can substantially improve fraud detection.’’

Utah-based Zions Bank is largely dependent on big data to detect fraud. Big data can detect a complex problem like cross-channel fraud by aggregating fraud alerts from multiple disparate data sources and deriving meaningful insights from them.

- Risk Management:

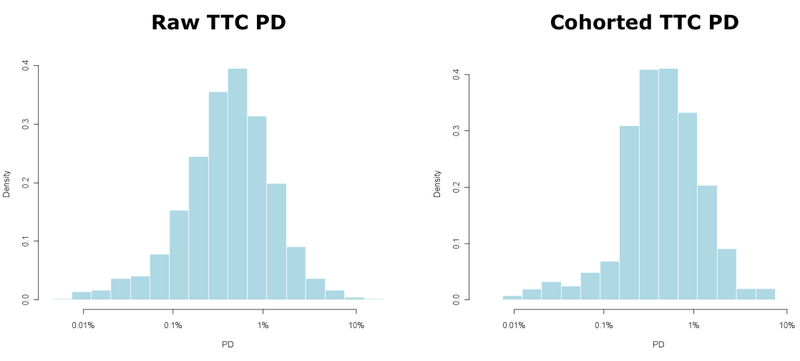

Financial markets are becoming more and more interconnected, which increases their risk. Big data plays a pivotal role in risk management of financial sector as it provides more extensive risk coverage and faster responses. It helps create robust risk prediction models that evaluate credit repayment risks or determine the probability of default on loans for customers. It also aids in identifying risk associated with emergent financial technologies.

Hence, banks need to adopt a big data culture to improve customer satisfaction, keep up with global trends and generate higher revenues.

For credit risk management courses online, visit DexLab Analytics. It is a leading institute offering credit risk analytics training in Delhi.

Interested in a career in Data Analyst?

To learn more about Machine Learning Using Python and Spark – click here.

To learn more about Data Analyst with Advanced excel course – click here.

To learn more about Data Analyst with SAS Course – click here.

To learn more about Data Analyst with R Course – click here.

To learn more about Big Data Course – click here.