The incident we are about to describe took place during 2009 circa at a party, a year in which the world was going through one of its worst financial crisis for the longest time. Every average bloke on the streets was aware of terms like mortgage-backed securities (MBS), sub-prime lending and credit crisis, after all these are the reasons for his plight.

But at this party we are speaking of, I was fortunate enough to meet with an informed and highly compassionate elderly woman, and after a few minutes of discussion the topic came to what we here do for a living. She wanted to know more about credit scorecard systems. As I further went on to explain the details of how this system works, her expression changed from being just plainly curious to angry to pained.

Eventually this lady interrupted me and asked – isn’t this whole system the root of all evil? Why would anybody do such a thing? That is what caused this entire mess. By the time I had grown quite familiar with this reaction and had to correct this widespread misconception.

As borrowers, you must realize that credit or application based scorecards are excellent tools for both lenders as well as borrowers, to work out their debt serving capability. As for lenders the scorecards can help them evaluate the creditworthiness of the borrowers and maintain a healthy portfolio, this in-turn will influence the economy as a whole. Furthermore, for the borrowers they can offer valuable information, like for example, 45 percent of people from a similar socio-economic background have struggled to maintain their EMI commitment. This would further help the borrower make an educated decision before getting into a debt-trap. However, in any case blaming a scientific method for recklessness of humans is not new and also not justified.

Any meticulous science with practical applications is similar to a sharp German blade, a master chef can prepare delicious meals with it, but the irresponsible can leave a deep and painful cut.

Classification problem in statistics and data mining:

Scorecards have their roots in the system of classification problem and statistics with data mining. The idea behind majority of classification problems is to make an effective mathematical equation to differentiate dichotomous variables.

These variables can only take two values such as the following:

- Male / female

- Bad / good

- Yes / no

- Devil / God

- Sad / Happy

- No sales / sales

This is in no way an exhaustive list, and can go on until eternity. The rationale behind why most business problems try to model with dichotomy is because it is easy for us to comprehend with our human minds. So, we must at this point start at appreciating that dichotomy is not absolute and has degrees attached to it.

Take this example for consideration, I am good 80% and bad 20%, this is what I like to believe. But I would keep the Pareto rule of 80-20 away from this assumption, which would suggest that my 20 percent bad is responsible for the 80 percent of my behaviour.

Credit scorecard development with sampling and problem statement:

When developing credit scorecard systems, the problem statement helps to distinguish analytically between good and bad borrowers. So, the primary task is to define a good and a bad borrower. For majority of lending products good and bad credit is defined in the following manner:

- Good loan: either never missed on an EMI or did once.

- Bad loans: missed 3 or more EMIs in a row consecutively (90 days past due)

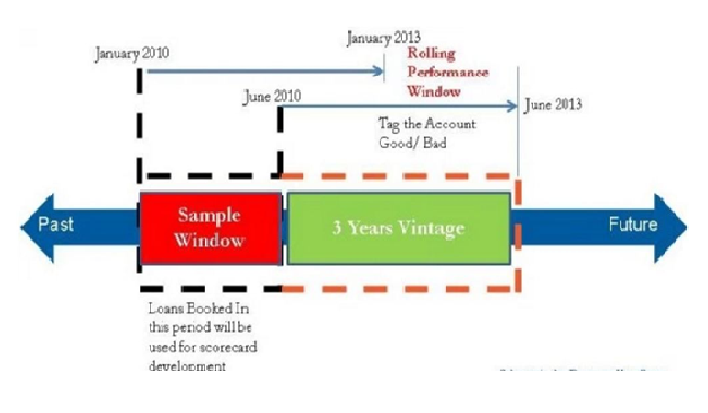

Furthermore, for tagging people good or bad one must observe their behaviours for a considerable amount of time. But this time span varies from product to product based on the loan tenure. As for home loans with tenure of 20 years, 2 to 3 years is a reasonable observatory period. However, there is nothing sacrosanct about the above definition which can be modified at the discretion of the analyst. Roll rate analysis along with vintage analysis are the 2 analytical tools you may want to consider when working with the above definition.

Sampling strategy for creating credit scorecards:

Which is a good sample size to achieve good precision? While he was looking for a one-size fits all model, but alas, the situation is not that simple. The size of the sample depends on the degree of sameness or that of homogeneity of the population in question. For instance, what do you think is a good size of a sample to answer the following two questions?

- Define the amount of salinity of the Pacific Ocean.

- Is there any other planet in the universe with similar intelligent life?

When it comes to population, the amount of drops in an ocean and the number of planets in the universe is all the same. With only a couple of ocean drops you can estimate the salinity of it as a whole because the salinity of the sea is fairly constant. But the second question is a Black Swan problem. For that we will need to visit every other planet to rule out the possibility of an intelligent life form on them.

But when creating a credit scorecard the accepted rule of thumb for the sample size is a minimum of 1000 records for both good loans as well bad loans. It is also advisable for the analysts to keep the window as short as possible for analysis of the sample, i.e. one fiscal quarter or at least two when it comes to scorecard development.

Here is a specimen of credit scorecard development sampling strategy:

For all-encompassing credit risk analysis course online, look up to DexLab Analytics. They offer premium Credit Risk Analysis online courses Delhi at the most convenient prices.

We will discuss more about credit scorecard development in detail with subsequent blog tranches.

Stay tuned.

Interested in a career in Data Analyst?

To learn more about Machine Learning Using Python and Spark – click here.

To learn more about Data Analyst with Advanced excel course – click here.

To learn more about Data Analyst with SAS Course – click here.

To learn more about Data Analyst with R Course – click here.

To learn more about Big Data Course – click here.