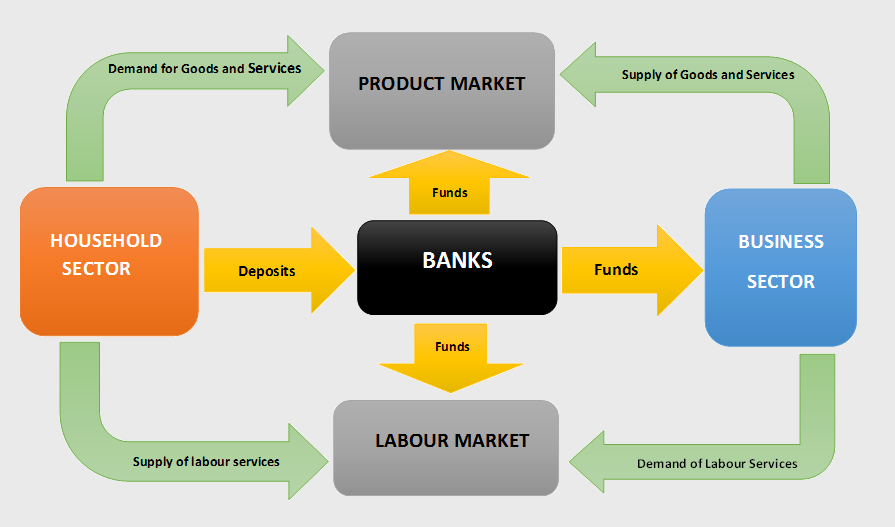

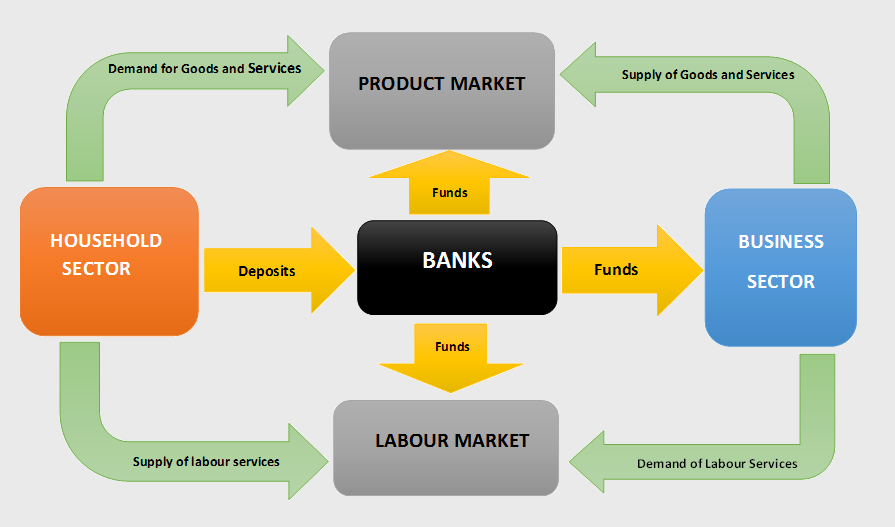

Banks, as financial institutions, play an important role in the economic development of a nation. The primary function of banks had been to channelize the funds appropriately and efficiently in the economy. Households deposit cash in the banks, which the latter lends out to those businesses and households who has a requirement for credit. The credit lent out to businesses is known as commercial credit(Asset Backed Loans, Cash flow Loans, Factoring Loans, Franchisee Finance, Equipment Finance) and those lent out to the households is known as retail credit(Credit Cards, Personal Loans, Vehicle Loans, Mortgages etc.). Figure1 below shows the important interlinkages between the banking sector and the different segments of the economy:

Figure 1: Inter Linkages of the Banking Sector with other sectors of the economy

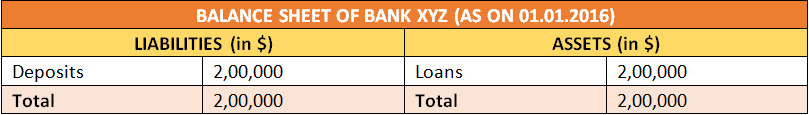

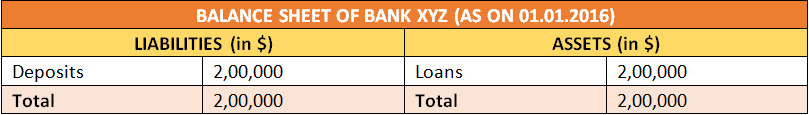

Banks borrow from the low-risk segment (Deposits from household sector) and lend to the high-risk segment (Commercial and retail credit) and the profit from lending is earned through the interest differential between the high risk and the low risk segment. For example: There are 200 customers on the books of Bank XYZ who deposit $1000 each on 1st January, 2016. These borrowers keep their deposits with the bank for 1 year and do not withdraw their money before that. The bank pays 5% interest on the deposits plus the principal to the depositors after 1 year. On the very same day, an entrepreneur comes asking for a loan of $ 200,000 for financing his business idea. The bank gives away the amount as loan to the entrepreneur at an interest rate of 15% per annum, under the agreement that he would pay back the principal plus the interest on 31st December, 2016. Therefore, as on 1st January, 2016 the balance sheet on Bank XYZ is:

Consider two scenarios:

Scenario 1: The Entrepreneur pays off the Principal plus the interest to the bank on 31st December, 2016

This is a win – win situation for all. The pay-offs were as follows:

Entrepreneur: Met the capital requirements of his business through the funding he obtained from the bank.

Depositors: The depositors got back their principal, with the interest (Total amount = 1000 + 0.05 * 1000 = 1050).

Bank: The bank earned a net profit of 10%. The profit earned by the bank is the Net Interest Income = Interest received – Interest Paid (= $30,000 – $10000 = $20,000).

Scenario2: The Entrepreneur defaults on the loan commitment on 31st December, 2016

This is a drastic situation for the bank!!!! The disaster would spread through the following channel:

Entrepreneur: Defaults on the whole amount lent.

Bank: Does not have funds to pay back to the depositors. Hence, the bank has run into liquidity crisis and hence on the way to collapse!!!!!!

Depositors: Does not get their money back. They lose confidence on the bank.

Only way to save the scene is BAILOUT!!!!!

The Second Scenario highlighted some critical underlying assumptions in the lending process which resulted in the drastic outcomes:

Assumption1: The Entrepreneur (Obligor) was assumed to be a ‘Good’ borrower. No specific screening procedure was used to identify the affordability of the obligor for the loan.

Observation: The sources of borrower and transaction risks associated with an obligor must be duly assessed before lending out credit. A basic tenet of risk management is to ensure that appropriate controls are in place at the acquisition phase so that the affordability and the reliability of the borrower can be assessed appropriately. Accurate appraisal of the sources of an obligor’s origination risk helps in streamlining credit to the better class of applicants.

Assumption2: The entire amount of the deposit was lent out. The bank was over optimistic of the growth opportunities. Under estimation of the risk and over emphasis on growth objectives led to the liquidation of the bank.

Observation: The bank failed to keep back sufficient reserves to fall back up on, in case of defaults. Two extreme lending possibilities for a bank are: a. Bank keeps 100% reserves and lends out 0%, b. Bank keeps 0% and lends out 100%. Under the first extreme, the bank does not grow at all. Under the second extreme (which is the case here!!!) the bank runs a risk of running into liquidation in case of a default. Every bank must solve an optimisation problem between risk and growth opportunities.

The discussion above highlights some important questions on lending and its associated risks:

- What are the different types of risks associated with the lending process of a bank?

- How can the risk from lending to different types of customers be identified?

- How can the adequate amount of capital to be reserved by banks be identified?

The answers to these questions to be discussed in the subsequent blogs.

Stay glued to our site for further details about banking structure and risk modelling. DexLab Analytics offers a unique module on Credit Risk Modelling Using SAS. Contact us today for more details!

Interested in a career in Data Analyst?

To learn more about Data Analyst with Advanced excel course – Enrol Now.

To learn more about Data Analyst with R Course – Enrol Now.

To learn more about Big Data Course – Enrol Now.

To learn more about Machine Learning Using Python and Spark – Enrol Now.

To learn more about Data Analyst with SAS Course – Enrol Now.

To learn more about Data Analyst with Apache Spark Course – Enrol Now.

To learn more about Data Analyst with Market Risk Analytics and Modelling Course – Enrol Now.