With more and more sectors turning to AI to find real-time solutions, it is no wonder that AI would gain momentum in the field of credit risk management as well. AI adds efficiency to the process by offering an insight into the portfolios of potential borrowers, which was not available to financial firms up until now. This trend is pushing corporate houses to sign up for credit risk analytics training.

Let’s have a look at credit risk management and figure out how AI can play a key role in building the perfect model.

What is credit risk management

Banks and financial firms lend money to individuals as well as businesses, now credit risk refers to the uncertainty arising due to that borrower, delaying or failing to pay the amount borrowed along with interest resulting in the bank losing money. Remember that infamous recession of 2008?

Credit risk management is about mitigating the risk factor in the process. It involves identifying, analyzing, and measuring the risk factors to keep the risk at a minimal level, or, eliminating the risk if possible.

How AI features in credit risk management

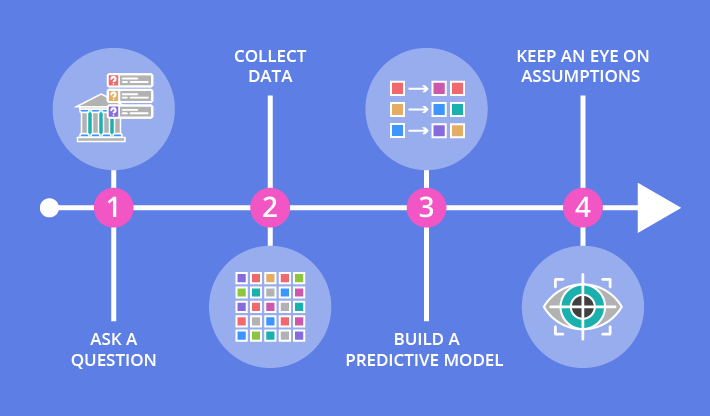

In order to eliminate risk, the bank needs to identify the risk factors, which means going through data, mainly regarding the borrower’s financial activities, portfolio to decide whether that particular individual or, a commercial firm would be able to pay the money back before lending can happen.

But, the process needs to be as much error-free as possible, because while analyzing the portfolios any mistake could lead to failure to recognize a potential defaulter, or, might result in rejecting an applicant who could have been a valuable customer in future. Credit Risk Modelling Courses are being developed to train professionals to deal with this highly specialized task.

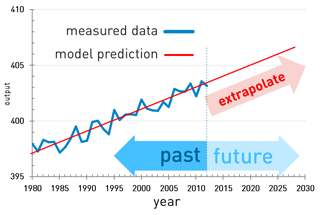

AI and especially its subset Machine Learning come into this picture, due to the massive amount of structured and unstructured data involved in the process. The traditional methodology applied by financial institutes is not error-free. processing a huge amount of raw data and identifying patterns is a job that is better handled by AI.

The benefits AI bring to the table

Despite financial firms implementing all sorts of solutions available to them, achieving efficiency in credit risk management has remained a challenge for them due to not having access to smart risk assessment tools, fault in the data management procedure. This is primarily the reason why AI is now being incorporated in the process to achieve better results. With Artificial Neural Networks, Random Forest in place, sorting through loan applications and portfolios to process valuable data and finding patterns becomes easier. Undergoing credit risk modelling certification is almost mandatory for any individual looking forward to having a career in this field. Here are the benefits AI has to offer

- Data quality: When traditional models are employed they fail to deal with the issue of data quality which for any financial institute could be a big problem. But with Machine learning detecting any oddity in the data entry is easy. Another fact is that detecting complex patterns from diverse data sets to analyze risk factors is essential which traditional models are not equipped to perform.

- Segmentation is better: While analyzing customer portfolios, AI could help in introducing smart segmentation solutions to gain a deep insight into their profiles, thus ensuring efficient risk recognition.

- Automated process: Usually organizations have to put together a team for dealing with data handling and report generation tasks, but AI can automate the whole process and minimize the chances of human error while allowing the organizations to set people free to deal with other vital work. Automation would also lead to faster loan processing.

- Intuitive analysis guarantees accuracy: Usually, traditional models are somewhat rigid, due to functioning as per set guidelines. However, with AI the analysis gets intuitive and as it continues to wade through new data sets, it continues to learn and come up with more accurate predictions.

Credit risk management will continue to be a key area for financial firms in the future as well, given the present circumstances, the risk factor would only grow. So, it is time for this sector to recognize and embrace the potential of AI in mitigating the risk.

.