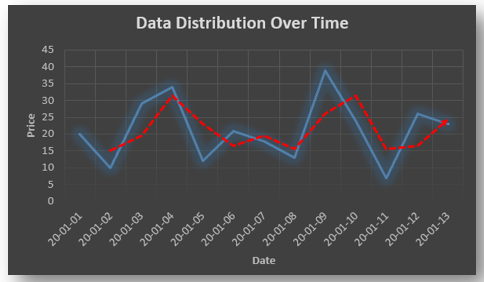

Business Intelligence, or BI, is crucial for organizations as strategic planning is heavily dependent on BI. BI tools are multi-purpose and used for indicating progress towards business goals, quantitatively analyzing data, distribution of data and developing customer insights.

Advanced computer technologies are applied in Business Intelligence to discover relevant business data and then analyze it. It not only spots current trends in data, but is also able to develop historical views and future predictions. This helps decision-makers to comprehend business information properly and develop strategies that will steer their organization forward.

BI tools transform raw business information into valuable data that increase revenue for organizations. The global business economy is completely data driven. Companies without BI software will be jeopardizing their success. It is time to shed the belief that BI software is superfluous. Rather, it is a necessity.

Here is a list of 10 important things that BI solutions can help your organization achieve. After reading these you will be convinced that BI is vital in taking your business forward.

- Provide speedy and competent information for your business

Nowadays, there isn’t much time to ponder over data sheets and then come to a conclusion. Decisions have to be taken on the spot. Valuable information doesn’t include business data alone, but also what the data implies for your business. BI gives you a competitive lead as it provides valuable information with the push of a button.

- Provide KPIs that boost the performance of your business.

Business Intelligence software provides KPIs (Key Performance Indicators), which are metrics aligned with your business strategies. Thus, businesses can make decisions based on solid facts instead of intuition. This makes business proceedings more efficient.

- Employees have data-power

BI solutions help employees to make informed decisions backed by relevant data. Access to information across all levels ensures company-wide integration of data. This helps employees nurture their skills. A competitive workforce will help a company gain global recognition.

- Determine the factors that generate revenue for your business

Business intelligence is able to determine where and how potential customers consume data, how to convert them to paying customers, and chalk out an appropriate plan that will help increase revenue for your business.

- Avoid blockages in markets

There are many BI applications that can be incorporated with accounting software. Business intelligence provides information about the real health of an organization, which cannot be determined from a profit and loss sheet. BI includes predictive features that help avoid blockages in markets and determine the right time for important decisions, like hiring new employees. Easy-to understand dashboards enable decision-makers to stay informed.

- Create an efficient business model

As explained by Jeremy Levi, Director of Marketing, MarsWellness.com, ‘’ Why is BI more important than ever? In one word: oversaturation. The internet and the continued growth of e-commerce have saturated every market…For business owners, this means making smart decisions and trying to know where to put your marketing dollars and where to invest in infrastructure. Business intelligence lets you do that, and without it, you’re simply fumbling around for the light switch in the dark.”

- Improved customer insights

In the absence of BI tools, one can spend hours trying to make sense out of previous reports without coming to a satisfactory conclusion. It is crucial for businesses to meet customer demands. BI tools help map patterns in customer behavior so businesses can prioritize loyal customers and improve customer satisfaction.

- Helps save money

BI tools help spot areas in your business where costs can be minimized. For example, there is unnecessary spending occurring in the supply chain. BI can identify whether it is inefficient acquisition or maintenance that is translating to increased costs. Thus, it enables businesses to take the necessary actions to cut costs.

- Improve efficiency of workers

Business intelligence solutions can monitor the output of members and functioning of teams. These help improve efficiency of the workers and streamline the business processes.

- Protects businesses from cyber threats

Cyber crimes like data breaches and malware attacks are very common. Cyber security has become the need of the hour. Businesses should invest in BI solutions equipped with security tools that help protect their valuable data from hackers and other cyber attacks.

Businesses will progress rapidly through the use of smart BI solutions. Organizations small or big, can use BI tools in a variety of areas, starting from budgets to building relationship with customers.

If you want to empower your business through BI then enroll yourself for the Tableau BI certification course at DexLab Analytics, Delhi. DexLab is a premium institute providing business analysis training in Delhi.

Interested in a career in Data Analyst?

To learn more about Machine Learning Using Python and Spark – click here.

To learn more about Data Analyst with Advanced excel course – click here.

To learn more about Data Analyst with SAS Course – click here.

To learn more about Data Analyst with R Course – click here.

To learn more about Big Data Course – click here.

![]()