BASEL accords are a set of agreements set by the Basel Committee on Banking Supervision(BCBS) which provides recommendations on banking regulations in regard to credit risk, market risk and operational risk. The purpose of the accords is to ensure that the financial institutions have adequate capital on account to meet obligations and absorb unexpected loss. There are three versions of BASEL: BASEL-I, II and III. BASEL-I is relatively more simple compared to the later versions, in the sense that, its scope of definition of risk was limited only to credit risk. BASEL-II is a more advanced version of its predecessor in defining the scope and domain of banking risk. It points out three main areas of risks: Minimum Capital Requirements, Supervisory Review and market discipline. These are called the three pillars of BASEL. The focus of BASEL-II has been to strengthen the international banking requirements as well as to supervise and enforce these requirements. BASEL-III is the recent most version of the BASEL accords and most banks seeks compliance with it by the end of 2018. BASEL-III discusses the three pillars professed by BASEL-II in a more detailed manner by increasing the scope of the three pillars. In this blog we will discuss the three pillars of BASEL accords and the opportunities they generate in the analytics industry.

Pillar 1: Minimum Capital Requirements

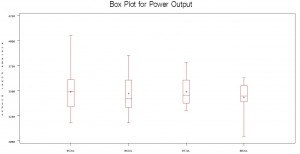

BASEL-II emphasises that banks must have adequate capital to cover the three areas of risk exposure: Credit risk, Operational Risk and Market Risk. Credit risks are those which arise from the default on the loans made to obligors. The default occurs when obligors fail to make required payments. Operational Risk arises from failed internal processes. It includes legal risk, but excludes strategic and reputation risk. Market risks arise from losses on and off balance sheet position arising from movement in market prices. Statistical models are extensively used to develop predictive models for identifying the credit, operational and market risks. Probability of Default (PD), Loss given Default (LGD) and Exposure at Default (EAD) models are built to identify the inherent credit risk in the bank’s portfolio. Market risks are modelled using Value at Risk (VaR) and Economic Capital (ECAP) models. Building these models require a sound understanding of (i) the relevant business for which model development is done (ii) statistical techniques like Logistic Regression, Linear Regression, Time Series Analysis (both basic and advanced) (iii) segmentation techniques like CHAID, CART, Cluster analysis etc. and (iv) a very good understanding of soft wares like SAS, EXCEL and R.

Pillar 2: Supervisory Review

It provides with a framework to deal with risk related to systemic, pension, strategic, concentration, liquidity, legal and reputational. The accord combines all these risks under the title of residual risk. The aim of this pillar is to give better tools to the regulators. Black-Scholes-Merton of option pricing forms the basis of modeling for most of these risks (especially systemic risks). In order to develop this type of model you are required to have sound knowledge in terms of simulation Stochastic processes.

Pillar 3: Market Discipline

Market discipline supplements regulation as sharing of information facilitates assessment of the bank by others, including investors, analysts, customers, other banks, and rating agencies, which leads to good corporate governance. The aim of Pillar 3 is to allow market discipline to operate by requiring institutions to disclose details on the scope of application, capital, risk exposures, risk assessment processes, and the capital adequacy of the institution. It must be consistent with how the senior management, including the board, assess and manage the risks of the institution.

Banks require being compliant with all the three pillars of BASEL accords for prudently managing their risks. Hence Systematically Important Financial Institutions like Wells Fargo, HSBC, American Express, Bank of New York Mellon etc. look for resources with sound understanding of these pillars and the statistical knowledge required building models for their captive risk management process. Managing banking risk is perhaps the safest business to invest in as the extent of risks and regulatory compliance for banks are increasing overtime. Over the next few blogs we will try to understand the capital structures of banks and development of different BASEL compliant models for different pillars and capital tiers of banks.